Gaming AI Company, Sett, Appears With $27 Million in Funding

Sett is a Tel Aviv based company specializing in AI-orientated game marketing, in terms of its proprietary AI engine which can create interactive adverts based on a game’s existing design. Sett has been steadily building up a substantial client base over the last few years under the radar, but has now broken cover to reveal its hefty $27 million investment.

Launched in 2022, Sett now counts companies such as Unity, SciPlay, and Zynga as clients. Its AI engine works, in short, by copying everything about a game and replicating it but as a video or playable ad. The company posted on its official LinkedIn page about the funding news.

“We’re beyond thrilled to announce our emergence out of stealth with our $27M funding. Thanks a million (or 27 million to be exact) to our investors for helping us reach this milestone.”

“We’re incredibly excited to partner with Bessemer Venture Partners, F2 Venture Capital, Arcadia Gaming Partners (Akin Babayigit), vgames, Saga Ventures, and others who deeply believe in our mission.”

Jump to:

The Names Behind The Money

Those investor names might not ring any bells for the average gamer, but the gist is that they back start-ups working in interesting areas of tech. Saga, for example, focuses its investments on other companies dabbling in AI-generated content, such as Icon (which makes AI influencer ads) and Vapa (an AI voice tool for developers).

Vgames is an investor more focused on the game side of things, as it backs game companies all the way from ideation to monetization. This last word, monetization, is the key theme when it comes to Sett.

Grabbing Gamers by The Eyeballs

Sett, and its AI engine, are linked with what’s called UA (User Acquisition). Mobile gaming, in particular, involves a lot of this, since many of the games are ostensibly free to play and rely on drawing new players in as much as retaining existing ones.

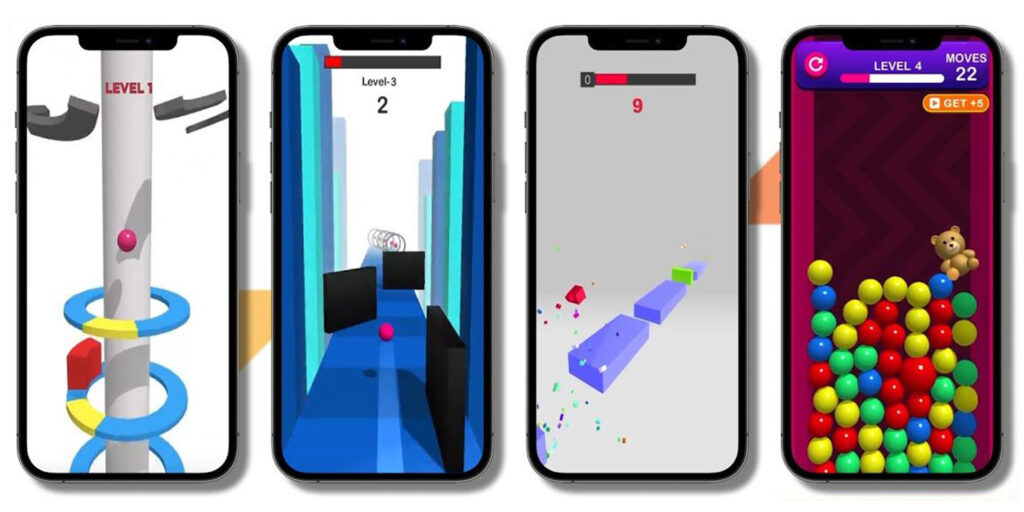

The most common form of UA in mobile gaming is the playable ad. These are everywhere, including sandwiched into other free-to-play titles, and often rarely resemble the actual game they’re selling. But, they’re effective, especially in the hyper casual market (games with abstract or minimalist graphics that tend to incorporate simple runner or merge mechanics).

In an interview with Unity in December 2024, Samantha Benjamin, Director of Growth and LiveOps at Supersonic (a mobile game publisher), outlined how and why hyper casual games are so common.

“The hyper-casual genre played a pivotal role in bringing new players into the mobile gaming ecosystem. By offering easy-to-understand gameplay and high marketability, it effectively acted as a ‘funnel’ for converting non-gamers into mobile gamers,” she said.

“Furthermore, hyper-casual helped expand the ad ecosystem by generating a massive volume of impressions that advertisers could buy. This expanded supply helped major gaming studios diversify their UA strategies, reaching users more effectively through ad-supported apps.”

Aside from Sett, the investment firm Saga also backs Reddit, which is now considered a prime source for UA. As noted by Upptic, another mobile game marketing agency, social media is fast becoming a powerful tool for finding new players.

“TikTok, for instance, has emerged as a formidable UA platform, boasting high conversion rates and effective bidding strategies tailored for mobile games,” the company said in a post on its site. “Similarly, Reddit is also gaining traction among game publishers due to its ability to target users based on specific interests and topics.”

What This Means For Gamers

AI-generated content is everywhere these days, including as game assets and even to build games. Therefore, it could be considered a natural progression that similar tools would be put to use for game marketing.

Sett’s substantial funding and big-name client base show that the people with the money also think it’s a viable option. For example, at the end of 2023, mobile game publisher and marketing company TapNation announced $15 million in funding, before then acquiring UA Hero, an AI-powered mobile app user acquisition platform similar to Sett.

What this all means is that not only is AI-generated game marketing not going away, it’s set to ramp up. How this will affect actual game production, particularly in terms of studios behind mobile games, remains to be seen.

But, it stands to reason that the AI tools used by companies like Sett will give those studios a lot more control over how collected data is used to tailor an ad. It’s also not unreasonable to expect an increased wave of AI-generated game adverts that better resemble the flavor of the month than the actual games they’re selling.