Recent Report Concludes To Absolutely No One’s Surprise That Gamers Spend Money On Geek Culture

- A new report finds gamers spend heavily on hobbies beyond gaming, including anime, toys, and tabletop games

- Platform choice strongly predicts spending habits across different geek culture sectors

- Women lead in social gaming, while men spend more on comics and print media

- Nearly 40% of gamers plan to increase their spending on geek culture in the next year

Jump to:

Gamers Are Investing Beyond The Screen

Video game marketing agency Big Games Machine has released new research examining how gamers’ spending extends well beyond digital entertainment, and proved, once and for all, that marketing will spend money on just about anything to prove what has been known for decades.

The report, titled “Gamers and Geek Culture: What Gamers Spend On and Why,” surveyed more than 1,000 U.S. gamers to explore how their interests overlap with broader aspects of geek culture such as anime, collectables, and tabletop games.

“This report provides a compelling case for why video games are often the central hub of a cross-media strategy. Gamers are an incredibly valuable audience, and understanding how their passions transcend from digital to physical is key for any company looking to engage with them,” James Kaye, Co-Founder at Big Games Machine, said.

The findings paint a detailed and easily predictable picture of how deeply gaming is intertwined with other entertainment sectors. While the global gaming market is projected by Newzoo to reach $189 billion this year, the broader web of spending linked to gaming culture is only beginning to attract serious attention.

For marketers and IP holders, the report suggests an evolving consumer ecosystem where brand loyalty extends across multiple platforms and mediums. Gamers are not confined to screens, they follow franchises and characters into every format that captures their attention – truly earth-shattering information.

Gaming Habits Drive Broader Cultural Engagement

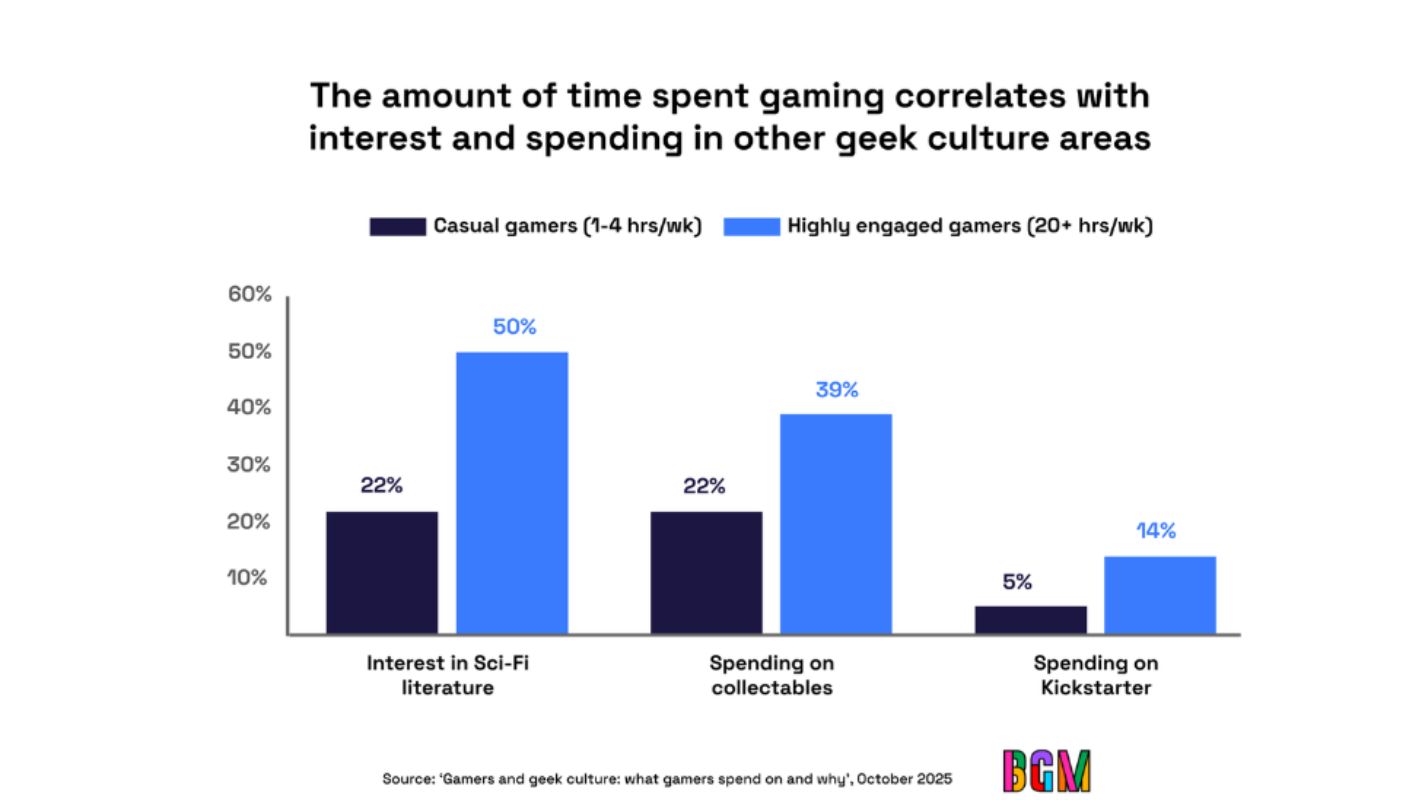

According to the survey, there is a direct link between the amount of time gamers spend playing and their engagement with other forms of geek culture. Those who play for more than 20 hours per week are more than twice as likely to invest in science fiction and fantasy literature compared to casual players. Anyone working in the gaming industry knows that the label “geek” is worn as a badge of honor by gamers.

“The modern gamer is at the very heart of the wider geek ecosystem. They’re not just playing games; they’re consuming comics, watching sci-fi movies, and buying board games based on IPs they love,” Kaye said.

This obvious connection highlights the increasing overlap between gaming and adjacent media categories, indicating that gamers represent a valuable audience segment across multiple industries. The more gamers play, the more they spend beyond gaming, reinforcing their role as major drivers of cross-media consumption.

As entertainment brands seek to expand across games, film, and physical merchandise, this finding underscores the potential of targeting heavy gamers with integrated marketing strategies.

Toys And Collectables Lead Gamer Spending

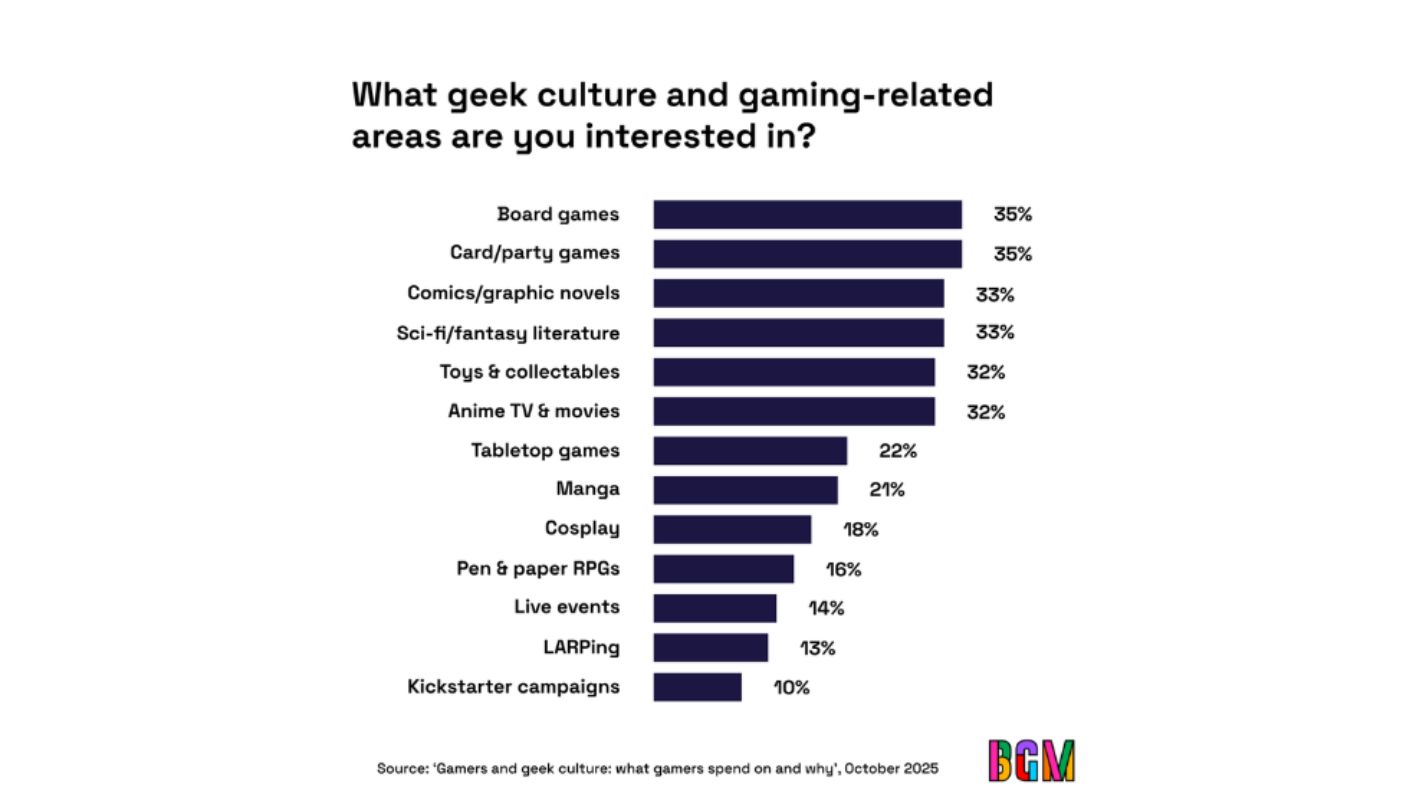

Toys and collectables stand out as the top spending hobbies among surveyed gamers, with 29% reporting purchases in the past year. This figure surpasses board games at 27% and card or party games at 24%.

This suggests that gamers are not only digital consumers but also active participants in physical fandom. Collecting figures, statues, or limited-edition items represents a tangible extension of virtual identities and digital interests.

The data points to a deep connection between intellectual property and merchandise, where passion for a game or franchise naturally extends into owning its physical representation.

Platform Choice Influences Consumer Behavior

The report identifies strong correlations between gaming platforms and spending patterns. Nintendo Switch users show a higher inclination toward collectables, while Xbox players demonstrate significant interest in tabletop gaming. Steam Deck owners stand out for their participation in crowdfunding, particularly through Kickstarter campaigns.

This diversity indicates that each gaming ecosystem cultivates distinct cultural habits and purchasing behaviors. Understanding these nuances provides marketers with opportunities to tailor cross-media campaigns based on platform demographics.

As gaming hardware becomes increasingly personalized, these findings reveal how platform communities are shaping broader cultural consumption.

Gender Trends Highlight Different Fandom Expressions

Gender-based differences also emerge from the data. Women are identified as leading participants in social gaming and are more than twice as likely to spend most on card and party games compared to men. Conversely, men show a stronger preference for print media, with 39% engaging with comics, compared to 27% of women.

These distinctions reveal not only purchasing habits but also the different ways in which audiences express their engagement with geek culture. Both groups contribute to the industry’s growth through varied but complementary channels of interest.

Marketers seeking to appeal to diverse audiences can leverage this segmentation to create more targeted campaigns.

Future Spending Signals Growth In Geek Culture

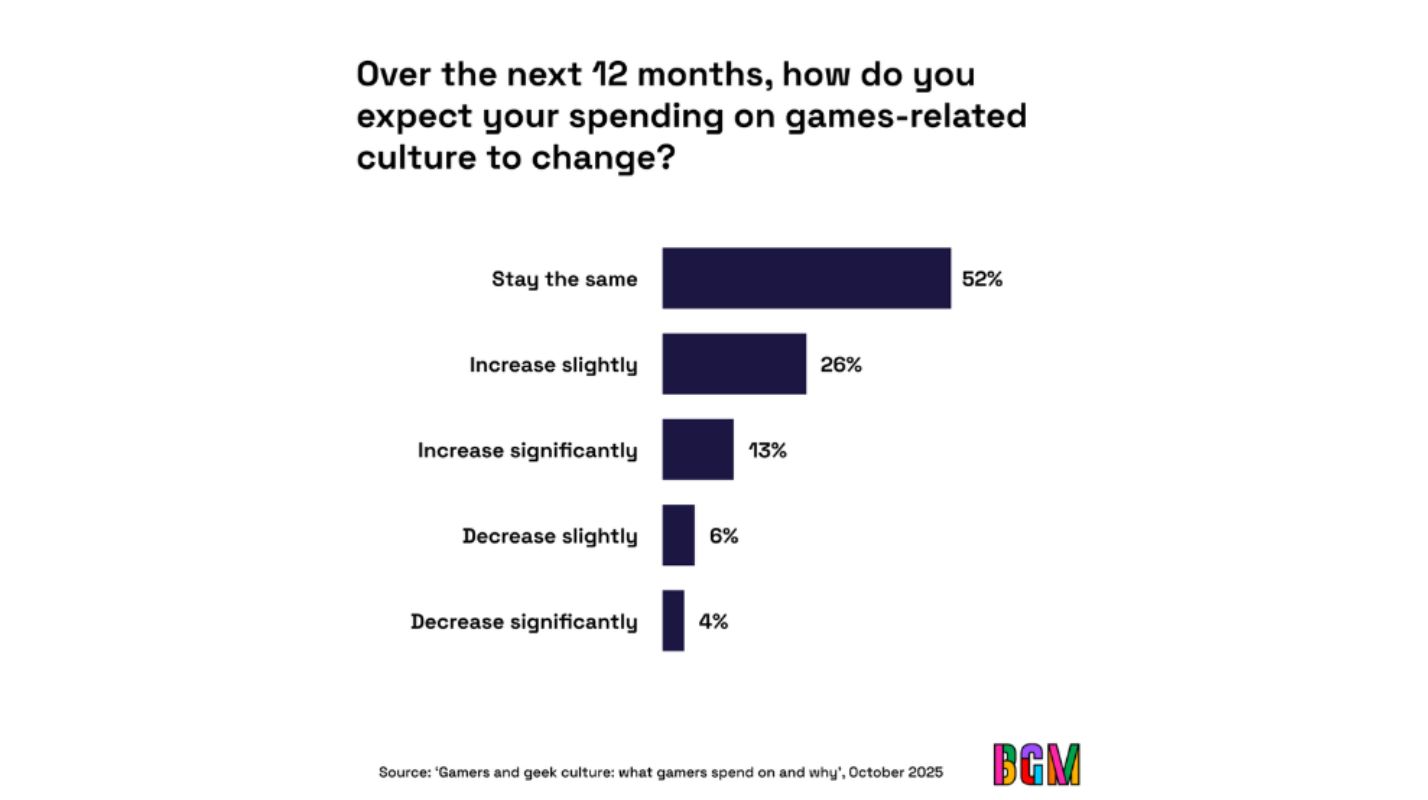

Nearly 40% of surveyed gamers expect to increase their spending on geek culture within the next year. This optimism suggests a healthy and expanding market for products and experiences that connect to gaming.

With franchises such as Magic: The Gathering and Fortnite bridging the gap between games, films, and merchandise, the concept of gaming as a central hub in a wider cross-media ecosystem is becoming a defining trend.

“The success of TV series like The Last of Us and Fallout, as well as character crossovers in Fortnite with Marvel and Star Wars, and collaborations like Magic: The Gathering Universes Beyond, proves that gamers are a uniquely receptive audience for cross-media storytelling,” Kaye said.

The line between digital and physical fandom has been blurred for a long time, but at least now there is a report to support what has been known for years. Armed with this data, marketers will be able to zero in on gamers with better accuracy, which must be what gamers have missed out on all these years.